Three Technologies are Set to Revolutionize the Insurance Industry in 2020

2020 Revolution in The Insurance Industry

The average loss to the insurance industry from riot and civil disorder catastrophes over those 70 years was only around $90 million. In 2020, the George Floyd protests became the first civil disorder catastrophe event to exceed $1 billion in losses to the insurance industry. In fact, it has exceeded $2 billion so far and could still go higher.

Top trends impacting the insurance industry in 2018

Accenture's Global Disruption Index—a composite measure that covers economic, social, geopolitical, climate, consumer and technology disruption—shows that levels of disruption have increased by 200% from 2017 to 2022. Previously, the Index rose by a mere 4% from 2011 to 2016. Insurance will reinvent and expand in new directions.

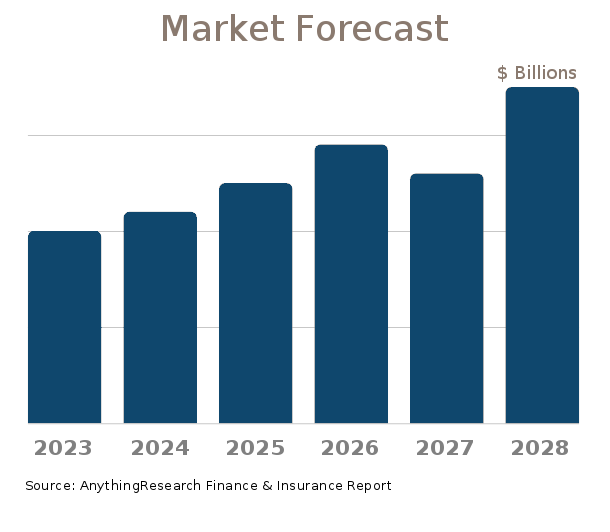

20222027 Finance & Insurance Market Forecast & Industry Outlook

In March of 2020, the global economic order was shaken by the advent of the novel coronavirus pandemic, which prompted widespread government lockdowns, business closures, and stimulus spending. Months into the pandemic, commentators began speaking of a so-called 'new' new normal' as citizens adjusted to the cultural and business changes.

"Insurance Industry Trends What's New and What's Next"

In February 2022, the inaugural McKinsey Global Insurance Report offered a comprehensive overview of the challenges and opportunities facing the global insurance industry. 1 "Creating value, finding focus: Global Insurance Report 2022," McKinsey, February 15, 2022. The 2023 report will be released in chapters and builds on that work with a new level of granularity and precision of.

2020 insurance industry outlook Deloitte Insights

2020, with the probability of a recession relatively high at 25 percent. Interest rates should remain at historically low levels, rising only to about 3.25 percent over the next five years.12 Life insurance and annuity growth may hit speed bumps On the life insurance and annuity (L&A) side of the business, global premiums are forecast to increase

top 5 health insurance companies in 20222023

An ongoing 'fight for the customer.' Insurtechs are driving digital innovation and disruption in the industry, with investments in insurtechs worldwide growing from $1 billion in 2004 to $7.2 billion in 2019 to $14.6 billion in 2021.More than 40 percent of insurtechs are focused on the marketing and distribution segments of the insurance value chain (Exhibit 3), enabling them to solve.

Insurance Industry 12 Trends for 2020 in the New Normal (OpEd)

Policygenius CEO Jennifer Fitzgerald shares insights on how the US insurance industry is managing risk and safeguarding consumers in the midst of the COVID-19 crisis.. volumes in the first few months of 2020 are 25 to 50 percent higher. Conversion rates remain strong too.. I think this has pushed the industry to adopt some changes much.

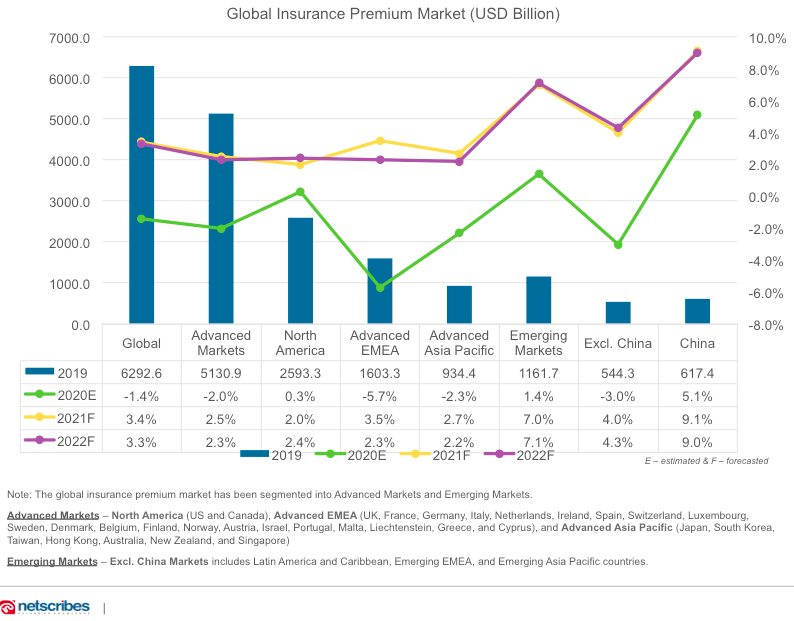

Insurance industry trends and outlook 2021 Netscribes

Insurance has undergone a transformation. As we described in our Future of Insurance 2020 report, the industry has faced demographic changes, rapidly evolving customer expectations, advancements in digital technology and analytics, and the challenge of maintaining a continued focus on innovative risk prevention. Though insurers acted

Changes in the Insurance Business That Will Affect You In 2020 2020

Societal and corporate commitment to DEI increased rapidly in 2020 following the death of George Floyd. 104 Insurers responded by initiating DEI-specific goals,. The insurance industry is facing change on an extraordinary scale. Insurance companies are wrestling with issues brought on by globalization, technological advances, regulatory.

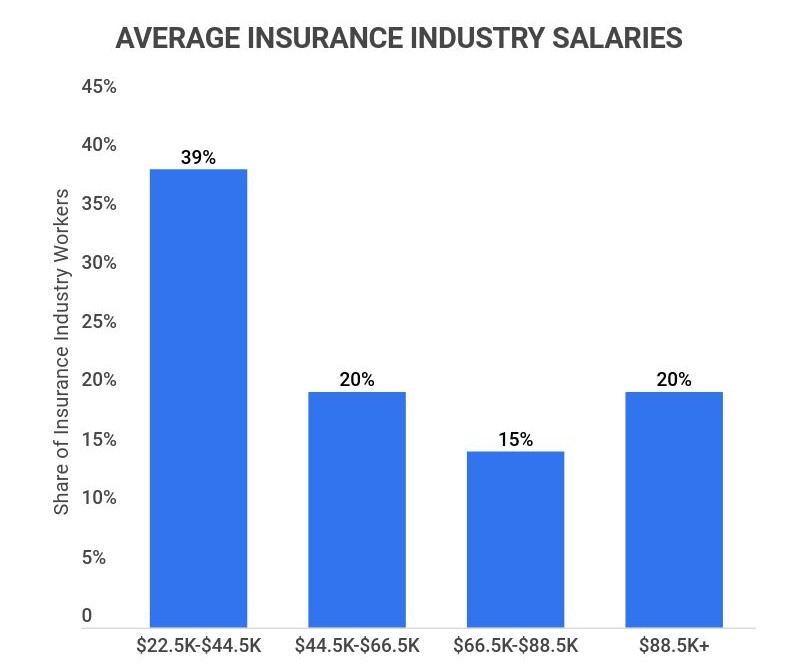

The 4 HR Trends Shaping the Insurance Industry in 2023

The growth rate of life premiums ranged from -29% in Lithuania to 42.2% in Turkey (and was even higher in Latvia). In the non-life sector, the fastest growth rate was recorded in Luxembourg with a 173.4% increase while the United Kingdom recorded the largest decline (-23.6%). Premium growth partly depends on the demand for insurance products.

COVID19 impact on the UK insurance industry how to keep your

The numbers are staggering by every measure. As of July 1, 2021, slightly more than a year after COVID-19 began to spread rapidly throughout the world, more than 180 million confirmed cases and 3.9 million deaths have occurred in the world's nearly 200 countries. 1 The International Monetary Fund calculates that the global economy shrank by 3.5 percent in 2020, 2 which is the deepest global.

Adapting to Change Insurance Industry Trends in 2023

Total life direct premiums grew 5.1% in the second quarter of 2019 to $46.7 billion, which was the industry's fastest rate of expansion since the fourth quarter of 2017. Growth in ordinary life premiums increased to 3.2% in the second quarter, up from 2.4% in the first quarter. Some of the rise in U.S. net written premiums for property-casualty.

20+ Interesting U.S. Insurance Industry Statistics [2023] Insurance

The disruption that is sweeping the insurance industry, and is set to increase, is the result of several key factors: Efficiency: The insurance industry has not been able to significantly improve its operating ratios. It still has a high operating cost base. Workforce productivity has shown little improvement.

Insurance Trends 2020 Find a New Roadmap to Growth

September 30, 2020.2 Given the pandemic's impact on employment, business activity, and trade, global nonlife premiums are expected to be flat for full-year 2020, including a 1% decline in advanced markets.3 However, despite these challenges, the industry may yet rebound to 3% growth in 2021, led by a

Most Valuable Insurance Companies 2020

The following major trends could shape and upend the insurance industry over the coming years, with profound implications for both policyholders and insurers. New Customers + New World = New.

13 Top Insurance Industry Trends 2021/2022 Data, Statistics

The insurance industry is under pressure. Social, technological, environmental, economic and political risks that seemed abstract or improbable just 20 years ago have become increasingly severe and acute and are affecting the very nature of the business. What's more, established business and operating models haven't kept pace.